|

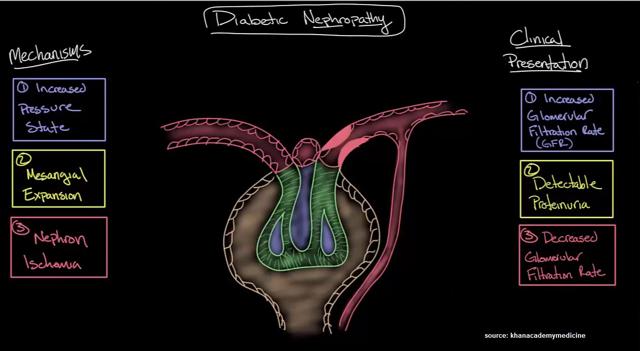

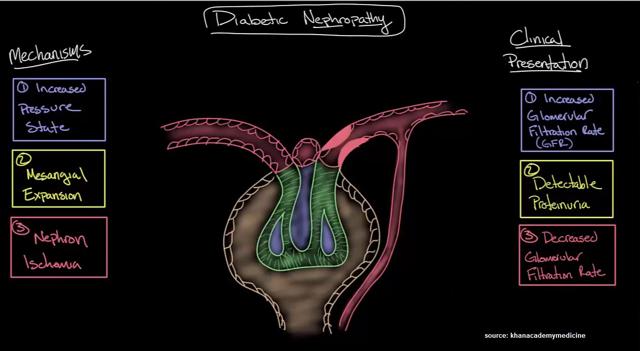

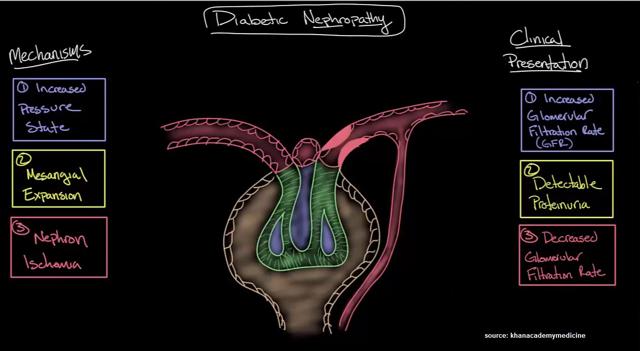

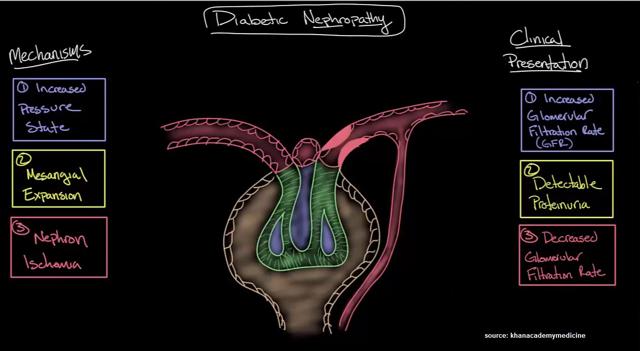

NephroGenex (NASDAQ:NRX) is developing pyridorin for the treatment of Diabetic Nephropathy (DN), a chronic debilitating condition that develops in patients with a combination of diabetes and Chronic Kidney Disease (CKD). The company is currently conducting a Phase 3 trial with pyridorin with top-line data expected around the middle of 2016. For the purpose of this article, I delve into the NephroGenex story and outline why I believe the shares are vastly undervalued given the existing data and potential market opportunity for pyridorin in DN. I start with a brief overview of both DN and CKD, and then discuss pyridorin, the data generated to date, the current Phase 3 study, the market opportunity, and conclude with valuation of the stock.

An Introduction To Chronic Kidney Disease And Diabetic Nephropathy

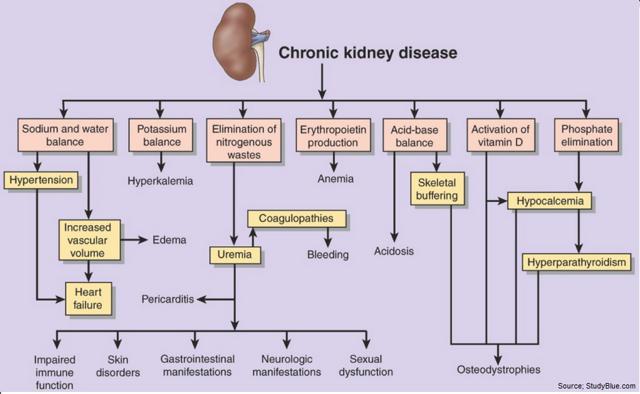

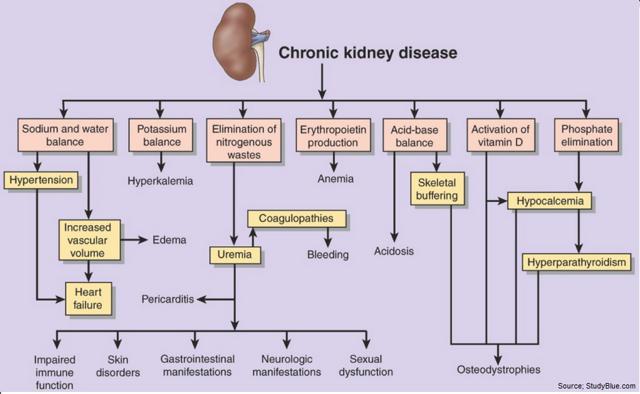

DN is one of the most common forms of CKD, which forms when kidneys - two fist-sized organs located in the back of the abdomen responsible for removing waste and excess fluid from the blood - begin to fail. The kidneys are also responsible for maintaining the right balance of salt and minerals in the blood and regulating blood pressure. As these vital organs become less efficient, for whatever reason, excess waste and fluids can build up in the blood, causing swelling in the feet and ankles, weakness, insomnia, cramping, vomiting, dyspnea (shortness of breath), and dry / itchy skin. A failing kidney can result in high blood pressure, anemia, and nerve damage. It can also lead to cardiovascular and blood vessel disease. Complete kidney failure leaves a patient dependent on dialysis or in need of a kidney transplant.

According to the National Kidney Foundation, 26 million American adults have CKD, with millions others at increased risk (1). Diabetes and high blood pressure are the two primary causes of CKD, responsible for up to two-thirds of all cases. In diabetics, chronically high blood glucose levels can lead to damage of many internal organs, including the kidneys and heart, as well as blood vessels, nerve endings, and the eyes. Similarly, hypertension can cause damage to the heart and kidneys, creating a dangerous loop where the two conditions continue to get worse if uncontrolled. Other conditions that affect the kidneys include: Glomerulonephritis, a group of diseases that causes inflammation and damage to the kidneys' filtering units; Polycystic Kidney Disease, which causes large cysts to form in the kidneys and damage the surrounding tissue; and Lupus.

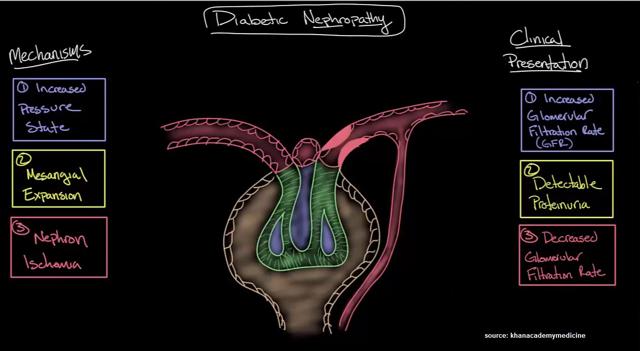

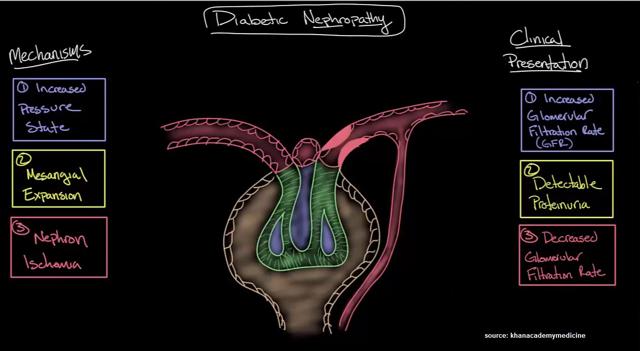

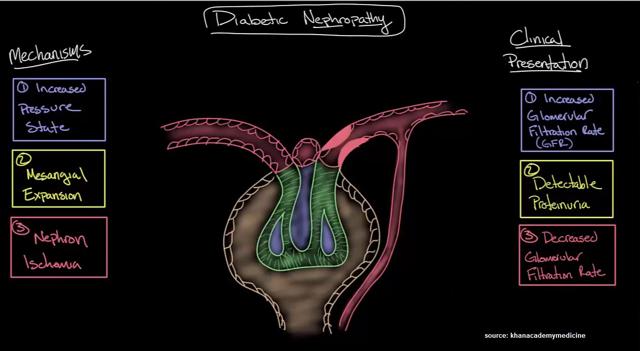

DN is a form of CKD characterized by persistent albuminuria in the blood at levels in excess of 300 mg/d or 300 ug/min, a progressive decline in glomerular filtration rate (GFR), and elevated arterial blood pressure. Currently, DN is the leading cause of CKD in the U.S. and Europe. It is also one of the most significant long-term complications in terms of morbidity and mortality for individual patients with diabetes (2). It is likely that the pathophysiology of DN involves a multifactorial interaction between metabolic and hemodynamic factors. Metabolic factors involve glucose-dependent pathways, such as advanced glycation end-products and their receptors. Hemodynamic factors include various vasoactive hormones, such as components of the renin-angiotensin system (3). These changes damage the kidney's glomeruli (networks of tiny blood vessels), which leads to the hallmark feature of albumin in the urine (called albuminuria).

DN affects approximately one third of people with Type 1 or Type 2 diabetes (4). In the U.S., roughly 12% of the adult population, or approximately 26 million Americans, have diabetes. The prevalence rate is increasing in older age groups, with nearly 27% of population above the age of 65 years old having diabetes according to a 2001 study by the U.S. Center for Disease Control & Prevention. As such, in the U.S. alone, it is estimated that 8.5 million individuals have DN. According to a commissioned study conducted by L.E.K. Consulting in 2010, approximately 2.8 million diabetic patients in the U.S. had overt nephropathy, about 3.5 million patients had early stage disease, and roughly 3.6 million patients were considered to be at high risk for developing the disease (9.9 million Americans total) (5).

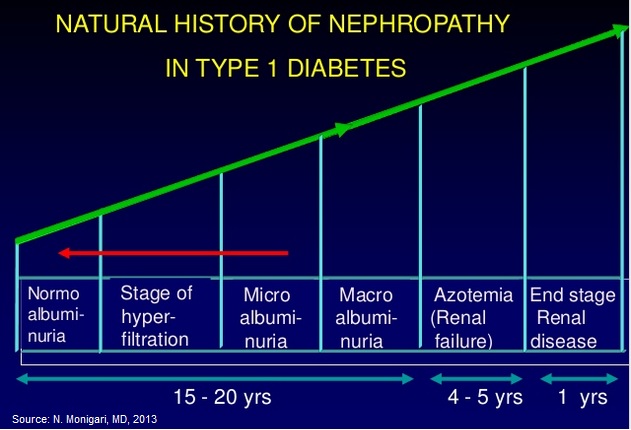

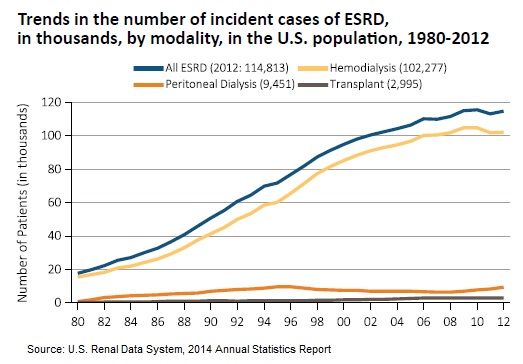

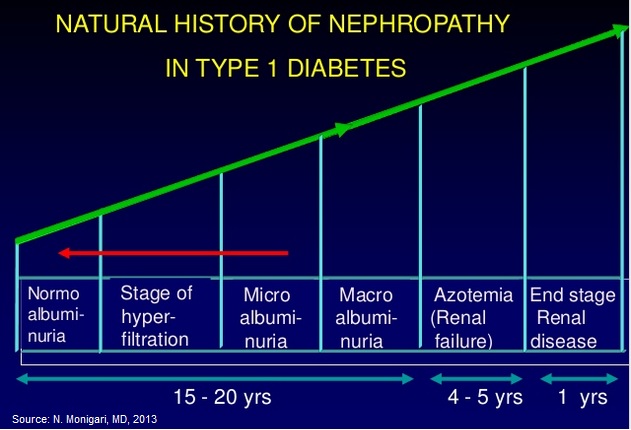

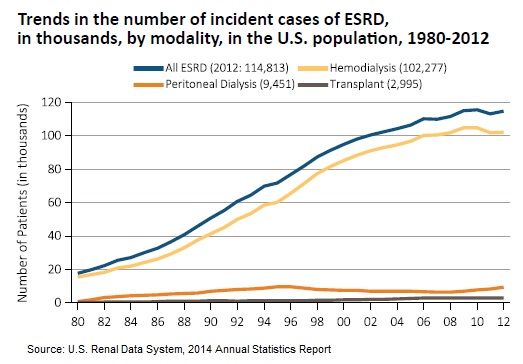

There are two stages of DN, microalbuminuria (incipient nephropathy) and macroalbuminuria (overt nephropathy). Microalbuminuria, which is defined as a urinary albumin excretion ranging from 30 to 300 mg in a 24-hour urine collection, generally precedes overt nephropathy by 5 to 10 years. Macroalbuminuria, which is defined as a urinary albumin excretion of ?300 mg in a 24-hour urine collection, generally precedes the failure of the kidneys over the next 10 to 15 years. The primary risk for patients with overt nephropathy is developing end-stage renal disease (ESRD). In fact, diabetes is the primary cause of ESRD in the U.S at about 40% of all cases. Once a patient develops ESRD, they require dialysis or a kidney transplant. Dialysis costs upwards of $65,000 per patient per year and a kidney transplant costs approximately $75,000 for the pre-treatment and surgery. End-stage renal disease is considered life-threatening, and has a 20% annual mortality rate in the U.S.

…Existing Treatment Options For Diabetic Nephropathy…

The primary strategy for the treatment patients with DN is to first control the underlying diabetes, which starts with healthy glycemic control. Diabetes medications include use of insulins, insulin secretagogues (sulfonylureas), meglitinides, insulin sensitizers (metformin, thiazolidinediones), glucose absorption inhibitors, biguanides, and dipeptidyl peptidase-4 inhibitors, among others (6). Controlling the diabetes and maintaining good glycemic control helps delay the onset of excess albumin in the blood and may even work to reverse structural damage caused by high blood glucose levels.

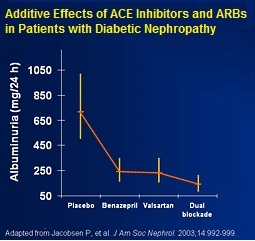

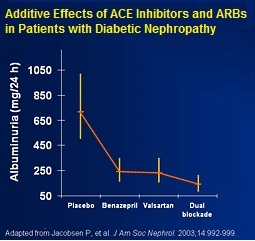

The second strategy is to control the high blood pressure. Medications used to treat high blood pressure include angiotensin-converting enzymes (ACE) inhibitors, angiotensin II receptor blockers ((ARBs)), beta blockers, calcium channel blockers, diuretics, and renin inhibitors (7). Recent meta-analyses and retrospective studies show that these are effective treatment options in slowing disease progression to diabetic nephropathy (8, 9, 10).

Unfortunately, despite a number of treatment options for both diabetes and high blood pressure, a significant number of diabetic nephropathy patients continue to see declines in kidney function to the point where they progress to macroalbuminuria and end-stage renal disease. That's because drugs like ACE inhibitors and ARBs do not treat the underlying cause of the disease, they only treat the symptoms. Additionally, even on optimized pharmaceutical therapy, which may include a combination of the aforementioned drugs, many patients still progress to end-stage renal disease.

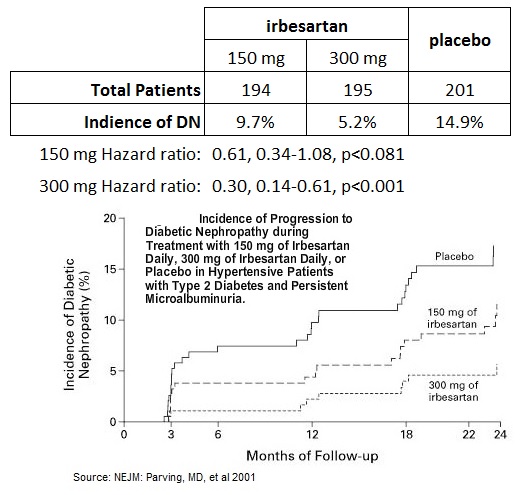

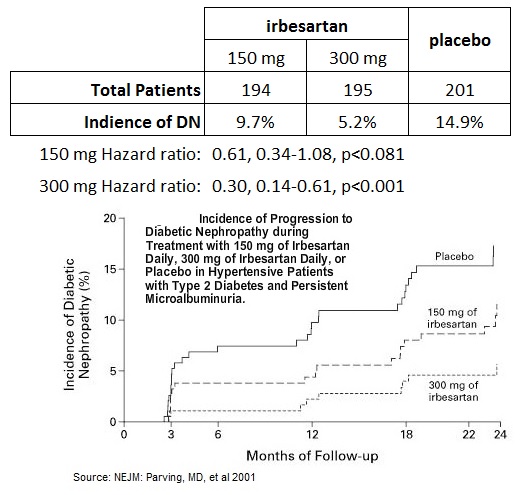

For example, a study conducted by researchers in Denmark enrolled 590 hypertensive patients with Type 2 diabetes and microalbuminuria, randomizing the patients to 150 mg or 300 mg daily of Sanofi-Aventis' ARB Avapro® (irbesartan) vs. placebo and followed for two years. The primary outcome was the time to the onset of diabetic nephropathy, defined by persistent albuminuria in overnight specimens, with a urinary albumin excretion rate that was greater than 200 ug per minute and at least 30 percent higher than the base-line level. The results are presented in the table and graph below (11). The data show that, despite Avapro® being a hugely successful drug for Sanofi, having generated peak sales in excess of $1.2 billion as recently as 2010, 150 mg of the drug did not achieve the primary endpoint in reducing incidence of DN in risk patients. The 300 mg dose did reduce the risk of incidence of DN with a hazard ratio of 0.30, 0.14-0.61, p<0.001, but at the end of two years, still 5.2% of patients developed the disease.

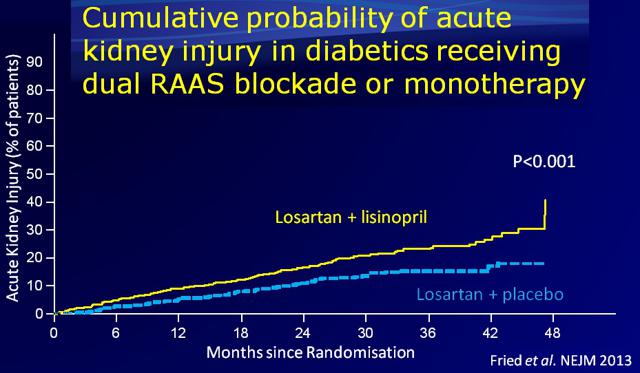

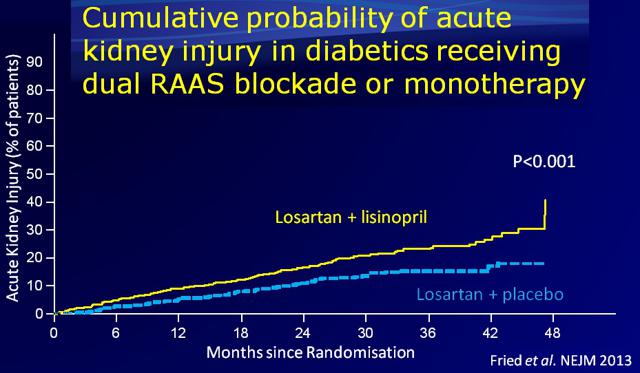

Physicians also need to be mindful of the side effects associated with the overuse of drugs like ACE inhibitors and ARBs. Results of a clinical study published in the New England Journal of Medicine in 2013 showed that a combination use of an ACE inhibitor (Lisinopril) when added to an ARB (Losartan) actually increased the risk of adverse events and acute kidney injury (12).

I believe this is evidence of a substantial market opportunity to treat at-risk diabetes patients. Blockbuster drugs like Avapro® do not completely prevent diabetic nephropathy and overly aggressive use of these drugs can actually have a detrimental effect on the kidneys.

Just 5% of the approximate 10 million or so patients at risk for end-stage renal disease still equates to a massive 500,000 patients. In the U.S., each year some roughly 120,000 patients have end-stage renal disease, with only 3,000 actually receiving a kidney transplant (13). This is the low-hanging fruit; but a new safe and effective treatment option could easily target a large portion of the entire market - potentially as much as 2-3 million patients in the U.S. alone.

Pyridorin For The Treatment of Diabetic Nephropathy

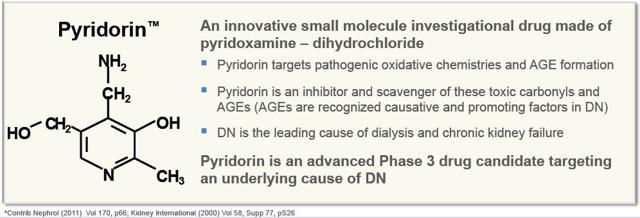

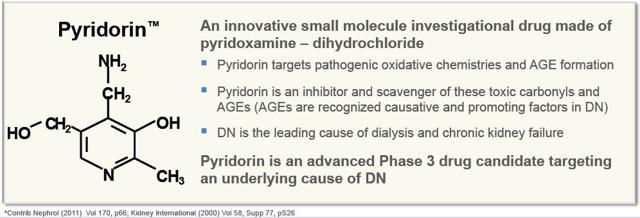

NephroGenex is developing Pyridorin (pyridoxamine dihydrochloride) to reduce the rate of disease progression in patients with diabetic nephropathy due to Type 2 diabetes. The drug is an oral, novel, small molecule structurally similar to vitamin B6 (pyridoxine). It works by inhibiting glycation reactions and the formation of advanced glycation end products (AGEs). The mechanism of action of pyridoxamine includes: (NYSE:I) inhibition of AGE formation by blocking oxidative degradation of the Amadori intermediate of the Maillard reaction; (ii) scavenging of toxic carbonyl products of glucose and lipid degradation; and (NASDAQ:III) trapping of reactive oxygen species (14). Preclinical data shows that Pyridorin also inhibits the formation of advanced lipoxidation end-products ((ALEs)) on protein during lipid peroxidation reactions. In addition to inhibition of AGE/ALE formation, PM has a strong lipid-lowering effect in streptozotocin (STZ)-induced diabetic and Zucker obese rats, and protects against the development of nephropathy in both animal models (15).

The original investigational new drug (IND) application on Pyridorin was filed by BioStratum, Inc. in July 1999. The company conducted 36 preclinical studies, five Phase 1 studies, and five Phase 2 studies with the drug. No inherent safety signals were seen in any of the early-stage programs, which included multiple doses up to 1200 mg. The company reports that pyridorin was well tolerated with no drug-related toxicity observed in any research subject during the five early-stage trials. In December 2014, NephroGenex successfully completed a thorough QT/QTc cardiac safety study showing no apparent effect on the QT/QTc interval with doses up to 1200 mg per day (16).

NephroGenex licensed the method of use patent to pyridorin from BioStratum, Inc. in May 2006. In May 2007, NephroGenex acquired all related patents and technology behind Pyridorin. NephroGenex went public via an IPO at $12.00 per share in February 2014, raising gross proceeds of $37.2 million (17). A month later, in March 2014, the company formed two research collaborations to help advance Pyridorin into Phase 3 clinical trials. The company partnered with the Collaborative Study Group (CSG), a leading nephrology academic research organization with 300 affiliated clinics worldwide and Medpace, a contract research organization with demonstrated expertise in nephrology (18).

…Phase 2 Data Shows Clear Proof-of-Concept…

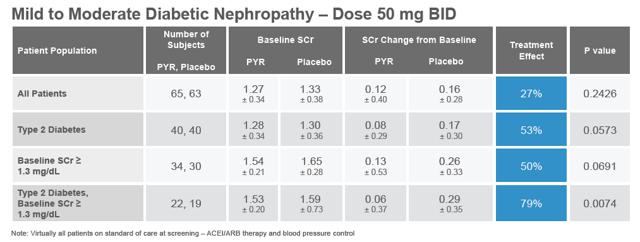

The first multi-center Phase 2 study with Pyridorin was conducted from October 2001 to January 2003 by BioStratum. The study, PYR-206, was primarily a safety and tolerability assessment of the 50 mg oral dose for 24 weeks in patients with nephropathy due to Type 1 or Type 2 diabetes. Post-hoc efficacy analyses were performed on various efficacy parameters, including serum creatinine (SCr), urinary creatinine clearance, and TGF- b 1. Creatinine is a breakdown product of creatine and its level in serum reflects the efficiency of the kidney to remove waste products from the blood. Serum creatinine is the most commonly used indicator of renal function.

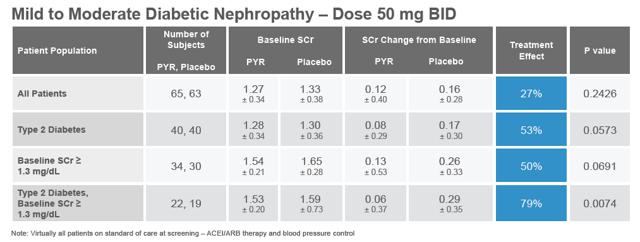

The results of the PYR-206 study are presented in the table below (pulled from the company's investor presentation). Although the results were not statistically significant, likely due to the small size of the study, there was an observed treatment effect in all patients, with a strong statistically significant effect in Type 2 diabetes with baseline SCr ? 1.3 mg/dL. Following the post-hoc efficacy analysis, BioStratum concluded that, "The result suggests Pyridorin therapy may be slowing the progression of kidney disease in diabetic patients with more substantial renal impairment exhibiting a larger increase in SCr over the treatment period."

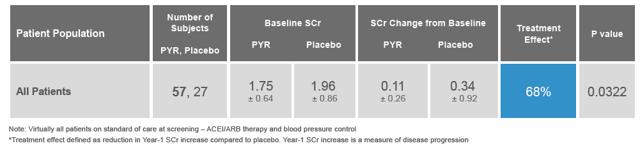

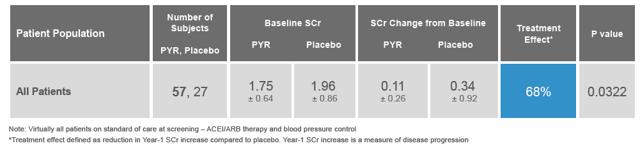

From July 2002 to September 2003, BioStratum conducted two similar Phase 2 studies, PYR-205 and PYR-207, differing only in the patient entry criteria (? 2.0 mg/dL for PYR-205 and between 2 mg/dl and 3.5 mg/dL for PYR-207). These were mid-sized, international, multi-center, placebo-controlled, dose-escalation studies with patients eventually receiving up to 250 mg BID of Pyridorin for 20 weeks. The data for both trials were merged, as prespecified in the statistical analysis plan. I present the data below as found in the company's recent investor presentation:

Pyridorin demonstrated an impressive 68% pooled treatment effect while being well tolerated. Relative to placebo, Pyridorin treatment slowed the rate of SCr increase (slope analysis) by approximately 70% in all populations analyzed. The rise in SCr was 0.177 mg/dL/yr in Pyridorin group (n=57) and 0.629 mg/dL/yr in the placebo group (n=27), with a P value of 0.062. No effects were seen on blood pressure or urinary albumin excretion.

The next step was a large, randomized, placebo-controlled multi-center Phase 2b study designed to test the effects of 150 mg BID and 300 mg BID vs. placebo for 12 weeks. The study, dubbed PYR-210, took place between August 2008 to August 2010 in the U.S., Australia, and Israel, and enrolled 307 patients on an intent-to-treat basis. To be eligible for the study, patients must have had macroalbuminuria and impaired renal function while on stable RAAS, ACE inhibitor, or ARB medication. Patients not on stable standard-of-care were required to go on standard-of-care for a two month run-in period before starting Pyridorin therapy (remember this, because it is important for the future).

PYR-210 did not reach its primary endpoint on the intent to treat (ITT) population. In the overall patient population, Pyridorin did not demonstrate a significant treatment effect on the progressive increase in serum creatinine (SCr) concentration after 12 months on therapy vs. placebo. The data are presented below as found in the company's Form S/1 from December 2013 (19). However, when the company went back and analyzed the data to remove the "run-in" patients - again these patients were not receiving standard-of-care such as RAAS, ACE inhibitors, or ARBs at baseline, the results did show a statistically significant treatment effect.

0 0

Before investors start accusing management of data-mining and spinning a failed trial into success, two key points should be known. Firstly, patients on established (or stable) standard-of-care at baseline exhibited a highly statistically significant dose-dependent effect. There is no denying the 300 mg BID dose worked better than the 150 mg BID dose and that the p-value for the 300 mg dose of <0.01 is both impressive and conclusive. Secondly, patients not on standard-of-care at baseline exhibited higher initial blood pressure, more frequent medication changes, drops in blood pressure, and confounding SCr measurements. It seems clear it was a mistake to include these patients in the study to begin with, or at the very least two months was not a long enough run-in period for these previously uncontrolled patients. When put into graphical form, the data look quite impressive in Pyridorin's favor:

1 1

I present one final data set from the Phase 2 Pyridorin clinical studies. Shown below is the change from baseline in transforming growth factor beta (TGF?), a known signal of fibrotic disease. Data from PYR-206, PYR-205/207, and PYR-210 shows a consistent and significant reduction in TGF? across all Pyridorin-treated patients relative to placebo. I believe this is evidence that Pyridorin has anti-fibrotic effects and this mechanism should be explored by NephroGenex (or its commercial partner). An anti-fibrotic effect within the expanding mesangial matrix will work to reduce glomerular atrophy and dysfunction that ultimately leads to proteinuria, hematuria, and eventually kidney failure.

2 2

…Phase 3 Underway…

In June 2014, NephroGenex initiated the patient enrollment for the Phase 3 clinical trials (20). The PIONEER program will include two identical double-blind placebo controlled Phase 3 trials, each designed to evaluate the safety and efficacy of Pyridorin at 300 mg BID compared to placebo in reducing the rate of renal disease progression in Type 2 diabetic patients. Each study will enroll approximately 600 patients randomized in a 1:1 ratio to receive either Pyridorin or placebo. The first trial, PYR-311, is currently enrolling patients with a goal of having >150 centers online in over 12 countries by the end of 2015. Management believes this trial will likely be fully-enrolled in the second quarter of 2016 (21).

The primary efficacy endpoints are time to a 50% increase in serum creatinine ((SCr)) levels or end-stage renal disease (ESRD). The Phase 3 study is 90% powered to detect a 28% treatment effect. As a reminder, the 300 mg BID cohort in the PYR-210 clinical study, when specifically looking at patients that enrolled and were stable on standard-of-care, showed a 57% treatment effect. NephroGenex reached agreement with the FDA in 2013 on a Special Protocol Assessment (SPA) for the PIONEER clinical program, and received Fast Track designation by the FDA for Pyridorin in diabetic nephropathy dating July 2002 (22).

During the course of the trial, an independent data safety monitoring board (DSMB) will review patients for safety. NephroGenex will conduct an interim analysis of the primary endpoint study after approximately 80 events have occurred. Management anticipates that this will occur around the middle of 2016. One of three outcomes is possible following the interim analysis:

- The study is on track to reach the primary endpoint,

- The study will need more additional events than originally planned to reach the primary endpoint,

- The study is unlikely to reach the primary endpoint and results should be examined to generate new hypotheses for investigation.

I believe this represents an interesting potential catalyst for investors. My best guess is that the DSMB states that the trial is on track to reach the primary endpoint. I base that off the strong Phase 2 data in the primary endpoint and relatively low hurdle for the Phase 3 study in comparison. To me, this looks like a major inflection point for the company in terms of both attractive new investors and advancing discussions with potential commercialization partners. I believe Pyridorin is a very attractive asset for a large pharmaceutical company like Sanofi, Novartis (NYSE:NVS), or Johnson & Johnson (NYSE:JNJ).

…A Nephrologists Take…

I spoke with a practicing nephrologist in Florida about the diabetic nephrology market and the potential for a drug like Pyridorin. The physician stressed the importance of finding patient early in the disease progression, ideally during hyperfiltration or microalbuminuria. This gives him the best chance to prevent overt nephropathy or renal failure. However, if this is not possible, the patient should immediately be put on standard-of-care, which includes a combination of ACE inhibitors or ARBs because the disease can progress rapidly and once out of control it is exceedingly difficult to get back under control. This seems to back up the company's claim that patients not on standard-of-care when screened for the Phase 2b PYR-210 study most likely should have been excluded. I note the enrolling Phase 3 study has made this important change.

The nephrologist I spoke to also stressed the importance monitoring of serum creatinine (SCr) levels as a biomarker of disease progression. Investors typically like hard endpoints for Phase 3 trials, like ESRD or death, but I believe that Pyridorin, if successful in providing at least a 28% reduction in SCr levels after 12 months, will be well received by nephrologists or endocrinologist when it comes time to sell the drug. Breakthroughs in this area are few and far between and my physician contact believes that Pyridorin has the potential to be a blockbuster drug pending positive Phase 3 results.

A Significant Market Opportunity

As noted above, there are approximately 26 million Americans with diabetes, and the number is expected to increase to over 50 million by 2025 (23). Diabetic nephropathy affects approximately one third of these people (4), or around 8.5 million according to the U.S. Center for Disease Control & Prevention. A separate study conducted by L.E.K. Consulting in 2010 found that approximately 2.8 million diabetic patients in the U.S. had overt nephropathy, about 3.5 million patients had early stage disease, and roughly 3.6 million patients were considered to be at high risk for developing the disease (9.9 million Americans total) (5).

Each year approximately 5% of the 2.8 million diabetics with overt nephropathy will go on to develop end stage renal disease, and despite advancements in the standard-of-care that includes newer and strong ACE inhibitors and angiotensin II receptor blockers, I estimate 50% of this population is being underserved and would try a new safe and effective medication like Pyridorin. Results from the Irbesartan Type 2 Diabetic Nephrology Trial (IDNT) showed a 20% relative risk reduction with irbesartan treatment compared to placebo, but even after that 20% reduction, still 40% of the irbesartan-treated patients saw a doubling of SCr levels and 50% experienced ESRD or death after only four years (24). I note 23% of the patients in IDNT discontinued early. Recall, irbesartan (Sanofi's Avapro®) produced peak sales over $1.2 billion.

3 3

Financial Position & Capital Structure

NephroGenex went public via an IPO at $12.00 per share in February 2014, raising gross proceeds of $37.2 million (17). In November 2014, the company closed on a $12 million term loan facility with East West Bank (25). The company took an immediate draw on the loan of $7 million. In May 2015, the company took down the remaining $5 million. Cash as of June 30, 2015, stood at $18.9 million, burning approximately $9.8 million from operating activities during the first three months of the year. Burn primarily consisted of $7.6 million in R&D and $3.7 million in G&A.

In July 2015, the company closed on a secondary offering of $6.6 million (net) by selling 1.5 million shares at $5.00 per share (26). The offering also included the sale of 1.5 million warrants exercisable at $6.25 per share over the next five years. Aegis Capital Corp. acted as the sole book-runner. The offering was not well-received by investors; it priced at a 20% discount to the previous trading day and the shares have slipped another 15% today from the offering price.

As of today, NephroGenex has 10.4 million basic shares outstanding, with another 1.4 million stock options and 1.6 million warrants. As noted above, 1.5 million of these warrants are exercisable at $6.25 per share and would provide additional capital of $9.4 million to the company if exercised. The loan facility with East West Bank matures in 2018.

Intellectual Property

There is no composition of matter patent on Pyridorin. The company has an issued method of use patent in the U.S. that does not expire until December 2028. This patent also covers the target patient population and relevant dosing. NephroGenex also has a manufacturing patent that does not expire until February 2025. The drug has been designated as a new chemical entity (NCE) by the U.S. FDA, and thus is protected for at least five years following U.S. approval. In Europe, the method of use patent goes until June 2029. The drug will receive 10 years of exclusivity post approval in the EU based on NCE status. NCE status also confers eight years of exclusivity in Japan and Canada. For the purpose of my valuation, I have assumed exclusivity on a global basis through the end of 2028.

Valuation & Recommendation

To value NephroGenex I have built a detailed discounted cash flow (DCF) model. I start with approximately 26 million diabetics in the U.S. and 33 million in Europe. We are including Europe in our valuation model because the company has stated publicly, "In the first quarter the company achieved another major milestone by gaining the support of the European Medicines Agency, EMA for the PIONEER study's end-point and clinical protocol. The EMA indicated that the current Phase 3 PIONEER program could be adequate to support a Marketing Authorization Application for full market approval in Europe" (27). According to the literature, approximately one-third of these patients will go on to develop diabetic nephropathy, with another one-third developing overt nephropathy and at high risk of end stage renal disease. The market opportunity in the U.S. looks to be at least 3.0 million patients, with another 5.5 million in Europe.

Existing treatment options target mainly the symptoms of the disease and work to reduce high blood pressure in an effort to stave off renal failure. That being said, I believe at least 50% of the market is vastly underserved given the hesitancy of physicians to double-up or aggressively prescribe ACE inhibitors or ARBs for fear of acute kidney damage. Discontinuation rates for these drugs range between 5% and 20% per year. I believe an effective treatment option like Pyridorin, should the Phase 3 trial meet the primary endpoint in slowing disease progression (through biomarker of SCr), would be well received by the nephrologist and endocrinologist community.

The majority of ACE inhibitors and ARBs are available as generics. They cost, on average, only $15 per month, or $150 to $200 per year. That being said, when these drugs were branded pharmaceutical products and under patent protection, the cost was almost 10x that amount. I believe Pyridorin can easily go for $1,000 to $1,500 per year. Novartis' new heart failure drug, Entresto® (valsartan/sacubitril) approved in July 2015, will go for $12.50 per day, or around $4,500 per year (28). The drug is a combination of an angiotensin II receptor type 1 (AT1) inhibitor and a neprilysin inhibitor. Clinical data on Entresto® shows the drug to be roughly 20% more effective than older-generation ACE inhibitors in preventing things like hospitalization and death from cardiovascular disease (29). I expect the pricing in Europe to be roughly 75% of the U.S. pricing.

I believe that 25% market penetration is likely given the significant unmet medical need and lack of effective treatment options. I'm using a 20% discount rate for the cost of capital - identical to the discount that the company offered to participants in the July 2015 secondary offering. I'm assuming NephroGenex can effectively partner Pyridorin in 2017 following the results of the interim analysis mid-2016. If these data are positive, I believe large pharmaceutical companies will conclude that Pyridorin is a blockbuster drug, with potential peak sales of $3.0 billion on a global basis.

For developing the drug into Phase 3 clinical trials, NephroGenex should be able to capture $200 million in pre-commercial milestones and negotiate a high-teens to low-20's royalty on sales. With modest future operating expense (note the company is planning to file an IND for an injectable formulation of Pyridorin in late 2015 for acute kidney disease) and a 25% effective tax rate (the company has an accumulated deficit of $63.0 million), NephroGenex should be able to generate significant cash flows from Pyridorin starting in 2019.

Below is a snap-shot of my DCF model. I have adjusted the cash flows down 50% for probability of success. I believe this is very conservative given the Phase 2b PYR-210 clinical trial showed a 57% treatment effect and the hurdle for success in the current Phase 3 PIONEER trial is only 28%. Nevertheless, even with a 50% probability adjustment, my model is showing the share fairly valued at $16.15 per share. This is roughly 275% upside from today. As such, I believe NephroGenex represents an attractive investment opportunity for investors with a 12 month time horizon.

4 4

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure:I am/we are long NRX. (More...)I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

Log in to explore the world's most comprehensive database of dialysis centres for free!

Log in to explore the world's most comprehensive database of dialysis centres for free!  Professional dialysis recruitment

Professional dialysis recruitment