Background

As readers know, I have taken a lot of interest in biotech companies, mostly the largest companies. These "horsemen" have established profit streams, sales forces and strong pipelines. The one development-stage company I have written about to date, Portola Pharmaceuticals (NASDAQ:PTLA), has two products in Phase 3 studies, and both could be major successes relative to PTLA's market cap.

This article describes an earlier-stage, highly speculative biotech stock, Acceleron Pharma Inc. (NASDAQ:XLRN). This Cambridge, Mass. company was formed over a decade ago. It is run largely by ex-Wyeth executives with prior experience in such biotechs as Genetics Institute. It is closely affiliated with Celgene (NASDAQ:CELG). Acceleron's scientific progression and close alliances with a larger partner are reminiscent of Regeneron (NASDAQ:REGN), one of the horsemen I admire so much.

XLRN shares are in a downtrend, but it is difficult to see a fundamental reason for this. The stock is around $34 as I write this and is down substantially from its high. I am long XLRN and have been adding more around $35 (all data per share where appropriate). This is the chart of XLRN since it went public at $15 in September of 2013:

XLRN peaked above $57 in January last year. Despite this sell-off, it has outperformed the biotech sector (NASDAQ:IBB) since going public. It has also outperformed every "horseman" biotech stock. So, I hope that I'm merely buying it during an extended consolidation. The underlying major trend still is positive as I see it.

The Introduction is in two parts and discusses first the scientific and then the business and financial aspects of Acceleron. The body of the article discusses each pipeline product in some detail.

Introduction to Acceleron

A. Scientific focus

Acceleron's pipeline consists of fusion proteins. These act as "traps" to diminish or come close to eliminating the activity of proteins that circulate in the blood. The function of these proteins is to bind to receptors at certain cells and thereby regulate gene expression within these cells. Acceleron's therapeutic fusion proteins block the binding of these naturally-produced proteins, thereby intervening to assist the body in dealing with a disease.

The proteins that Acceleron's fusion proteins bind to, or trap, are coded for by the TGFB gene. A fuller name for the acronym is transforming growth factor beta 1. In order to keep this article of general interest, I will try to omit the technical details and focus on what investors need to know to evaluate the business prospects of XLRN.

Acceleron has made advances in understanding some aspects of how a cell in one part of the body synthesizes a specific protein and secretes it into the bloodstream to reach a receptor on a different cell. That receptor then begins an intracellular signaling process that alters gene function. So gene A in one cell influences the way a completely different gene in cell B has the proteins it directs production of expressed.

Acceleron's therapeutic proteins prevent or limit that communication to favorably modify a disease process.

Acceleron has gained intimate knowledge of the 30 or so members of a "superfamily" of TGFB proteins. TGFB stands for transforming growth factor beta (and similar names). This focus on one group of proteins makes XLRN a platform technology company. Celgene was, for example, built on a platform technology, namely IMiDs. This technology led to Thalomid, the blockbuster Revlimid, and Pomalyst/Imnovid for multiple myeloma. Regeneron is now a platform technology company, with its VelociSuite technologies that allow it rapid and high-quality development of fully human monoclonal antibodies.

I give a premium to companies with a technology platform, as it increases their R&D productivity.

Acceleron's known therapeutic candidates are fusion proteins, as opposed to antibodies or other types of proteins. This is the technology that Regeneron began its successful run of approved products with, such as in its blockbuster Eylea. Other successful products that use fusion proteins are Enbrel and Orencia.

As Regeneron advanced, it developed proprietary antibody technology and moved away from fusion proteins. Acceleron may be doing the same thing. It has disclosed in its latest 10-K that it is now working with Adimab LLC, a leading monoclonal antibody contract company, to develop product candidates. I expect that Acceleron's goals are to move to antibody therapy from fusion proteins. Since Acceleron's core technology stems not from its choice of protein but from its knowledge of TGFB, switching from fusion proteins to antibodies would not harm its status as a (hoped-for) leading platform technology company.

One of the long-term benefits of having a platform technology is the ability to plan for multiple pipeline enhancements over a period of years. In this situation, it makes a lot of sense for such a company to partner with a larger company. Giving away half or more than half of lead products is a good strategy for these companies. It limits dilution, provides credibility and expertise, and still allows the young company to control 100% of unpartnered products.

Regeneron has done this with Bayer (OTCPK:BAYRY) with Eylea and with Sanofi (NYSE:SNY) with multiple pipeline products. Sanofi has made very large investments in REGN shares.

Acceleron's strategy has been similar. Its "big brother" is Celgene. Celgene has helped Acceleron in several ways, as is discussed Below

This leads us to the second part of this discussion, the financial and stock aspects of shares of Acceleron.

B. XLRN as a stock and as a financial entity

It was not long ago that XLRN's $1.1 billion market cap would have seemed high for a company without any products that have even reached Phase 3, but biotech is now a proven business sector, and that has changed a lot of valuation models.

XLRN went public in September 2013 at $15. In January 2014, the company was able to do a secondary offering at $50. This has left the company well-funded, and with Celgene now covering the pre-NDA trials for XLRN's major products, its cash burn rate is low.

The following, from page F-34 and F-35 of the 2014 10-K, summarizes Celgene's equity relationship with XLRN:

Celgene Corporation (Celgene)

In connection with its entry into the collaboration agreement with Celgene, on February 2008, the Company sold Celgene 457,875 shares of its Series C-1 Preferred Stock. As part of the Company's June 2010 Series E financing, Celgene purchased 36,496 shares of Series E Preferred Stock and received warrants to purchase 38,979 shares of common stock. As part of the Company's December 2011 Series F financing, Celgene purchased 1,990,446 shares of Series F Preferred Stock. In connection with the Company's IPO, Celgene purchased 666,667 shares of common stock. In connection with the Company's January 2014 public offering, Celgene purchased 300,000 shares of common stock. In May 2014, Celgene purchased 1,100,000 shares of common stock from five current shareholders of the Company. As a result of these transactions, Celgene owned 12.8% and 9.7% of the Company's fully diluted equity as of December 31, 2014 and 2013 , respectively. Refer to Note 9 for additional information regarding this collaboration agreement.

The strong equity interest from Celgene, including in May of last year, suggests that there is true and significant upside potential from XLRN shares at the current level.

Not all agree:

NASDAQ reports 32.25 million shares outstanding for XLRN. Of these, 1.97 million had been sold short as of 3/31, or about 6%.

This is at the high end of the range of short sales over the past twelve months. I view the increased short interest as a positive.

The company has a very satisfactory financial position, courtesy of its IPO and secondary offering, and Celgene's financing of late-stage trials of its lead pipeline candidates. In its February press release reporting on Q4 and full-year financial results, Acceleron said:

Cash Position - Cash and cash equivalents as of December 31, 2014 were $176.5 million. Acceleron expects that its cash and cash equivalents will be sufficient to fund the Company's operations into the second half of 2017.

This is an attractive aspect of XLRN's risk-reward situation.

The Celgene relationship has several favorable, risk-mitigating positives for XLRN shareholders:

If and when a product makes it to market, Celgene will pay Acceleron 20% royalty on sales, ramping up to as much as about 25%. Celgene will also provide substantial financial assistance to Acceleron's development of a sales force.

I am guessing that the first Acceleron/Celgene product could make it to market by very late 2017, though 2018 is a safer bet (though there are no guarantees that any XLRN product will ever make it to market).

With that extended introduction, next I'd like to discuss XLRN's potential revenue drivers for the next several years.

Acceleron's pipeline

I am not going to go into specific clinical trial data, as it is all generated from early-stage studies, but I will summarize my impressions of it. Additional and much more detailed information can be obtained from such sources as Acceleron's 10-K, Acceleron/Celgene press releases, Acceleron's presentations and Seeking Alpha updates on XLRN.

Acceleron has two classes of pipeline product candidates, those that are farther along in development and that Celgene is looking to take the rest of the way to marketing approval; and all the rest.

A. Celgene-licensed proteins

The two lead products, which Celgene is now handling and financing, are related proteins called sotatercept and luspatercept, which I will call 'Sot' and 'Lus' for simplicity. These fusion proteins elevate blood counts in certain disease states. Their proposed mechanism of action is different from the well-known EPOs (erythropoietins) such as Epogen and Eprex. As Acceleron explains in its 10-K, on pages 8-9:

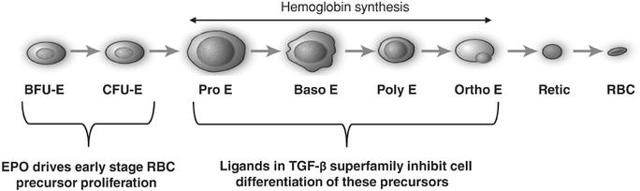

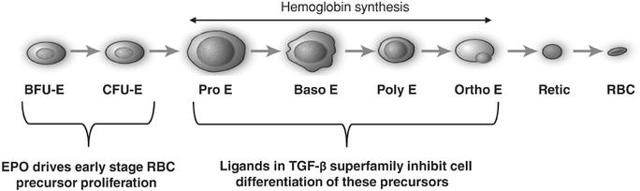

Erythropoietin is a positive regulator that stimulates proliferation of early red blood cell precursor cells, the BFU-E and CFU-E cells depicted in the figure below. Based on our research, it is now recognized that certain ligands in the TGF-ß superfamily are negative regulators of red blood cell precursors, starting with the Pro-E cells and those that follow, as depicted in the figure below. These members of the TGF-ß superfamily restrain the maturation of these precursors into later stage precursors and ultimately into functional red blood cells (RBCs).

(click to enlarge)

In certain diseases, the highly active process of red blood cell production does not function properly, leading to a reduction in the number of functional red blood cells, a condition known as anemia. Anemia in some disease settings is currently treated by the use of erythropoiesis stimulating agents, such as recombinant erythropoietin, that stimulate proliferation of early stage precursors of red blood cells. However, in certain diseases, such as ß-thalassemia and MDS, anemia is caused by defects in the production of late stage red blood cell precursors, which is known as ineffective erythropoiesis.

Anemias caused by ineffective erythropoiesis are not well-treated by current therapies. As shown in the illustration below, ineffective erythropoiesis is characterized by an over-abundance of early stage red blood cell precursors and a decreased ability of late stage precursor cells to properly differentiate into healthy, functional red blood cells. The resulting anemia stimulates the body's overproduction of erythropoietin, which exacerbates the over-abundance of early stage precursors. Because the defective step in ineffective erythropoiesis lies downstream of the early stage precursors, the increase in the number of these cells fails to resolve the anemia.

Note that a "ligand" is the natural protein that Acceleron's therapeutic fusion proteins bind to, thus stopping them from performing their normal function of binding to a receptor on a cell's surface.

In this case, the therapeutic effort prevents inhibition of red blood cell maturation, which is called "differentiation" in the diagram above. Preventing inhibition is a double negative, as it were. So far, this approach has provided benefits in several disease states, which are discussed briefly next.

Research to date suggests that Sot and Lus are effective in two rare diseases, beta-thalassemia and the anemia of MDS, (myelodysplastic syndrome), as well as in the less rare condition of renal failure. Celgene apparently intends to move forward with Sot and Lus in late-stage programs for all three of these conditions.

Celgene is highly sophisticated about MDC, as its Revlimid is approved for that condition as well as for multiple myeloma.

Assuming events move along well, Celgene plans to initiate Phase 3 studies for thalassemia and MDS by the end of 2015. Lus has been chosen for thalassemia, and no decision has been announced as to the candidate for MDS.

In addition, Sot is scheduled for a Phase 2b study for renal failure. To date, Sot has demonstrated a therapeutic trifecta in ESRD (renal failure). It has raised hemoglobin levels, reversed or mitigated the buildup of calcium in artery walls, and has also reversed or mitigated the loss of skeletal integrity - all common problems in dialysis patients. If successful, Sot could have very substantial sales in the ESRD market. I would even wonder if a robust Phase 2b program with strongly positive data could allow Celgene to file for marketing approval without a Phase 3 program with a commitment to perform Phase 4 post-approval research.

My sense, from Acceleron's disclosures and general knowledge, is that Sot and Lus are in a strong competitive position from a potential first-to-market consideration for all three of the above indications.

A major investment difficulty is guessing the accurate prescription numbers, time frame, and the selling price for the products if they reach market. Acceleron provides estimated numbers of patients with beta-thalassemia and MDS in its 10-K, but these are estimates. We do know that Celgene knows how to count and is not interested in paying for late-stage trials that address small commercial markets.

The way I think of these matters, taking thalassemia as an example, is as follows. If only 10,000 thalassemia patients get treated with Lus (the lead product for this disease), pricing of other biotech products for similarly severe or life-threatening conditions suggests a $250,000 yearly list price in the U.S. and lower elsewhere. If ASPs thus average $200,000, and assuming Acceleron makes only nominal sales through its own efforts, then thalassemia could quickly generate $2 billion in annual sales. In this scenario, all revenues are to Celgene, though eventually, more would accrue to Acceleron.

This scenario would provide a minimum of $400 million in annual pre-tax profits (royalties) to XLRN.

The commercial situation with MDS may be different. There is a higher prevalence of MDS than thalassemia, perhaps 125,000 patients, but unlike with thalassemia, anemia is only part of the problem with MDS. So the value from a Celgene/Acceleron anemia product for MDS for such a high price as for thalassemia would probably not be there. If so, perhaps Celgene will choose Sot for MDS, especially if its bone-strengthening qualities are considered positive attributes. Doing so would allow a higher price for Lus for thalassemia and a lower price for Sot for MDS.

My guess, though, would be that the revenues to XLRN could be the same for both conditions, and could be, combined, $1 billion per year or more. If anything like that actually eventuates in any reasonable time frame, XLRN's $1 billion current valuation would have to skyrocket.

That's a real guess, though, and again, these products may not reach the market at all.

The next subsection discusses projects not being funded by Celgene.

B. Acceleron wholly-owned products

i. Dalantercept is a fusion protein that Acceleron is developing for cancer. It is intended to block a step in blood vessel formation. One use for dalantercept would be in conjunction with a VEGF inhibitor. Another use would be as the only vascular growth inhibitor used in combination with a chemotherapeutic agent.

The lead indication for dalantercept is for renal cancer. It is in Phase 2 studies in combination with axitinib, branded as Inlyta, as salvage therapy for renal cancer. Some encouraging but preliminary data has been presented for renal cancer. Acceleron is also testing it for liver cancer.

Dalantercept has failed in early stage trials for a form of skin cancer and for pelvic female cancers. In the various Phase 1-2 trials so far, a number of cases of fluid retention have occurred, and some have been severe. Nonetheless, in its proposed indication for terminal cancer, this side effect would not stop doctors prescribing the drug if it were efficacious against the cancer.

I would not purchase XLRN based on the potential of dalantercept. It is, however, something for shareholders to watch closely, and positive news of efficacy with adequate safety parameters could, I believe, be a reason to consider making a new money purchase of XLRN.

ii. ACE-083

This early-stage fusion protein is described in the 10-K this way:

We are developing a novel therapeutic candidate, ACE-083, for a first-in-human clinical trial that we initiated in 2014. ACE-083 acts as a trap for ligands in the TGF-ß superfamily that are known to be involved in the regulation of muscle mass. By inhibiting these ligands, ACE-083 can increase muscle mass, as we have demonstrated in animal studies. ACE-083 has been designed to affect those muscles in which the drug is injected. In preclinical animal studies, ACE-083 has shown dose dependent increases in muscle mass in the injected muscles but no systemic increases in muscle mass. We are focused on the development of ACE-083 for diseases in which increases in the size and function of specific muscles may provide a clinical benefit, including inclusion body myositis, facioscapulohumeral dystrophy (FSHD) and disuse atrophy.

I find this interesting. If indeed it is found safe and effective for one of the above indications, at least one of which is an orphan indication, I can imagine that there could be massive off-label use of this for body sculpting, weight-lifting, etc. What controls would have to be put on the use of this product to prevent unauthorized use would be an important consideration.

There are probably enough indications for ACE-083 that it could become a material profit producer for XLRN even without off-label use.

iii. Early-stage candidates

The company describes its earlier-stage pipeline this way:

Our Preclinical Pipeline

We are using our discovery platform and knowledge of the TGF-ß superfamily to design and evaluate promising new therapeutic candidates that inhibit ligands of the TGF-ß superfamily. Additionally, in 2014 we expanded our discovery platform by entering a collaboration agreement with Adimab LLC under which Adimab will use its proprietary antibody discovery platform to generate fully human antibodies against selected targets.

We have preclinical stage therapeutic candidates in our pipeline that have shown promising activity in animal models such as:

- increase in systemic muscle mass;

- inhibition of liver fibrosis in mouse models of this condition;

- improvement of cardiovascular function in a mouse model of a fibrotic disorder of the lungs; and

- improvement in diseases of the eye such as in a mouse laser-induced neovascularization model of age-related macular degeneration..

These are interesting but not worth much at this stage. It is, however, very helpful that the company has this early-stage group of product candidates, showing that its research has been productive in this preliminary fashion.

All in all, the non-Celgene products in the pipeline have upside but may just not pan out. The interest I have in XLRN relates to Sot and Lus.

Patents

In general, the company's lead products have composition of matter and use patents either granted or pending. If issued and valid, they should protect Sot and Lus beyond 2025, perhaps a good deal longer.

Risks and limitations of this article

XLRN is a risky stock. It is in a short-term as well as an intermediate-term downtrend. There is no prospect of product revenue until late 2017 or later, if ever.

The major risks relate to the fact that none of the company's drugs has reached Phase 3 testing. Even the highly skilled team at Celgene has seen failures of promising drugs in Phase 3. There is no certainty, in fact, that Phase 3 studies will even commence.

Even if one or more of Acceleron's proteins is commercialized, safety issues, competition and other factors could lead to disappointing sales.

Apart from product-specific news, the biotech sector may fall out of favor with investors. If so, this could present significant risks to XLRN investors, who have no prospect of dividends given the company's current growth plans. Acceleron may even achieve significant revenues but no profits, and a different stock market environment may not look as favorably upon that business model as it does today.

There are many more relevant risks to an investment in XLRN. I characterize an investment in this stock as highly speculative.

The company's 10-K discusses numerous relevant risks to investing in XLRN, and as always it provides far greater and more detailed information about the company's operational status than this article.

One of the limitations of the analysis presented in this article is the early-stage nature of the products. There is limited information to go on, and essentially all of it is from Acceleron and Celgene. Another limitation is that I am and never have been an expert in anemia or intracellular signaling.

Concluding thoughts

The key to me for investing in XLRN is Celgene. Celgene is planning to take Sot and Lus to the next level of trials at its expense. Celgene has also bought substantial stock in XLRN, including at higher prices than current levels.

Beyond those two products, XLRN has an early- and mid-stage pipeline that is difficult to evaluate. The company is burning little cash at this point, so as matters stand, there may be no share dilution until 2017.

I hold XLRN as one of two preclinical biotechs in my portfolio, the other being PTLA.

CELG investors could look at XLRN in different ways. They could say that they constructively already own a little of XLRN, given the CELG investment. Or, they could say that with XLRN well off its high, they trust CELG enough to have a side investment in XLRN along with one in CELG.

I have the latter point of view at this time.

With this article, I have now provided 2015 updates on all the biotechs I currently own. Because of the many biotech companies that are now public, I may begin writing about stocks that I do not own.

I am long XLRN and looking to add a little more on dips if no fundamental negative news is present.

Disclosure:The author is long REGN,GILD,CELG,XLRN,PTLA. (More...)The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not investment advice. I am not an investment adviser.

|

Log in to explore the world's most comprehensive database of dialysis centres for free!

Log in to explore the world's most comprehensive database of dialysis centres for free!  Professional dialysis recruitment

Professional dialysis recruitment